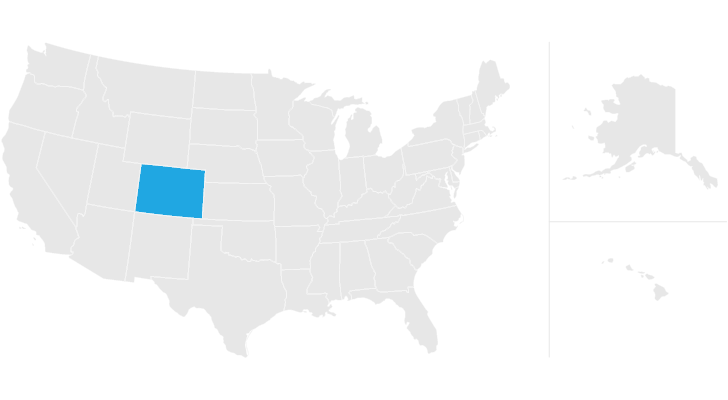

does colorado have inheritance tax

While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place. A state inheritance tax was enacted in Colorado in 1927.

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

The estate tax is different from the inheritance tax.

. A federal estate tax is in effect as of 2021 but the exemption is significant. As a matter of fact you may have to file one or more of these returns. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

There is no federal inheritance tax but there is a federal estate tax. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. Restaurants In Matthews Nc That Deliver.

The federal estate tax is due only on an estate worth more than 56. Inheritance Laws in Colorado Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. Colorado does not have inheritance taxes but there are federal estate taxes.

Inheritances that fall below these exemption amounts arent subject to the tax. Luckily the basic exemption for federal taxes is high so that most estates wont have to pay an. But that there are still complicated tax matters you must handle once an individual passes away.

The state of Colorado for example does not levy its own inheritance tax. Generally you do not have to report Colorado inheritance tax to the IRS. Up to 15 cash back Since 1980 there is no inheritance tax in Colorado.

An important note here however is that if the individual youre receiving inheritance from resides in a state with inheritance tax then it can. Does Colorado Have an Inheritance Tax or Estate Tax. If it does its up to that person to pay those taxes not the inheritors.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Opry Mills Breakfast Restaurants. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges.

Does Arizona have inheritance tax. There are no colorado inheritance tax. An inheritance tax may be due if you inherit money or property from a deceased person who lives.

No Colorado does not have an inheritance tax. This is because its typically not considered taxable income at the federal level. In some states a person who receives an inheritance might have to pay a tax based.

Some states such as delaware oregon washington and connecticut also have state estate taxes. There is no estatetax either. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other. Pennsylvania for instance as an inheritance tax that can apply to. Inheritance taxes are different.

Generally you do not have to report inheritance to the IRS as its not considered taxable income. There is no federal inheritance tax but there is a federal estate tax. There is no inheritance tax or estate tax in Colorado.

Arizona Inheritance Tax and Gift Tax There is no inheritance tax in Arizona. Colorado estate tax replaced the inheritance tax for decedents who died on or after Jan. Most capital gains in colorado are.

Up to 20 cash back Does Colorado have a state inheritance tax. 117 million increasing to 1206 million for deaths that. You may be required to pay inheritance tax if all of the.

Does Colorado Have An Estate Or Inheritance Tax. Colorado Inheritance Tax and Gift. The good news is that colorado does not have an inheritance tax.

That tax is levied after the money has passed on to the heirs of the recently deceased. No Colorado does not have an inheritance tax. Colorado does not have inheritance taxes but there are federal estate taxes.

No colorado does not have an inheritance tax. Unlike estate taxes the heirs are liable when there is an inheritance tax. However estate assets may.

Form 706 or 706NA for a nonresident. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. A state inheritance tax was enacted in colorado in 1927.

Until 2005 a tax credit was allowed for federal estate. Thats especially true for any. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

This Game Can Help You Divide Household Duties And Emotional Labor Fairly Fiber Optic Best Places To Retire Emotions

Estate Tax Inheritance Tax In Colorado

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

How To Sell An Inherited Home Wholesale Real Estate Real Estate Buying Real Estate Articles

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Colorado Estate Tax Everything You Need To Know Smartasset

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Cheapest Way To Harden Paint For Disposal Hunker Disposable Hunker Hardened

Estate Planning Estate Planning Estate Planning Checklist How To Plan

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

Filing For Taxes Online How To File Taxes The Budget Mom Online Taxes Budgeting Money Budgeting

Colorado Estate Tax Everything You Need To Know Smartasset

Panoramio Photo Of Night Fog Forest Grove

States With No Estate Tax Or Inheritance Tax Plan Where You Die